Common invoice exporting errors

This article is a guide to common error messages that may be displayed when exporting Invoices to Xero, QuickBooks or MYOB and how to manage them.

In some instances the exporting of invoices from Projectworks to an accounting system will fail. If one or more invoices fail to export, an error message will be displayed in the right hand panel. In many instances these errors can be remedied by making a simple change to the mapping within Projectworks or the accounting system.

Common Projectworks invoice export error messages

In most cases, a Projectworks administrator can manage the accounting system integrations and edit the mappings to enable the invoice export. In some instances a change may also be required in the accounting system that the invoices are being exported to. See error messages and steps to rectify below:

Error message: A tax type must be selected for all invoice lines before the invoice can be exported.

All budget lines in the invoice must have a tax type selected.

-

Open the Projectworks invoice where the error was invoked

-

Select to “Withdraw (set to draft)”

-

Expand the Budget lines in the invoice

-

Select a Sales Tax from the dropdown

-

In some instances this can be set to “No Sales Tax”, but some accounting systems will not allow invoices with no sales tax to be exported, and will require a 0% tax rate to be set up and mapped (see below).

-

-

Select “Approve (Finance)”

-

Re-export the Invoice

If the only Sales Tax option is No sales tax and this is not acceptable in the connected accounting system, a new Tax Rate will be required to be set up in Projectworks and mapped:

-

Go to Settings > System > Tax Types

-

Select the Add Tax Type “+” icon in the top right

-

Enter the New Tax Types' Name, Jurisdiction, Currency and Tax Rate

-

Select (or remove) the organisation(s) that the tax rate can be applied to if desired

-

Select “Create Tax Type”

-

Update accounting system Tax Types mappings in Projectworks

-

Go to: Settings > Integration > Accounting

-

If a sales tax type is not available in the mappings, this may be because it doesn’t exist in the accounting system, and will need to be set up accordingly.

Error message: An internal error occurred.

This error indicates there has been an internal error in exporting your invoice.

A Projectworks administrator can check the Invoice mappings are correct and retry exporting the invoice in the first instance:

-

Go to Settings > Accounting and take a look at the Invoice mappings

If the invoice mappings seem correct please contact support@projectworks.io.

Error message: BusinessEvent_DateOccurred_BeforeConversionMonth

This error indicates that the invoice date is earlier than the MYOB “Cannot record transactions before” date

If transactions should be recorded before this date, the MYOB administrator will need to update the Financial year Business details in MYOB to enable invoices dated prior to this date to be exported

Error message: BusinessLine_AccountHeaderNotAllowed

Error message: BusinessLine_AccountPostable

These errors indicate that the Projectworks GL code that has been mapped to an MYOB Header Account, and invoices cannot be posted to these accounts in MYOB.

-

Go to Settings > Accounting

-

Scroll down to the Accounting System and click on the three horizontal dots to “Edit Mappings”

-

Edit the Revenue GL Codes mapping from the MYOB AccountRight Account Name (Code) dropdown options (to an account that is not a Header Account in MYOB)

-

Select “Update Mappings”

-

Re-export the Invoices that failed

Please note: to view a list of your accounts in MYOB, go to the Chart of accounts

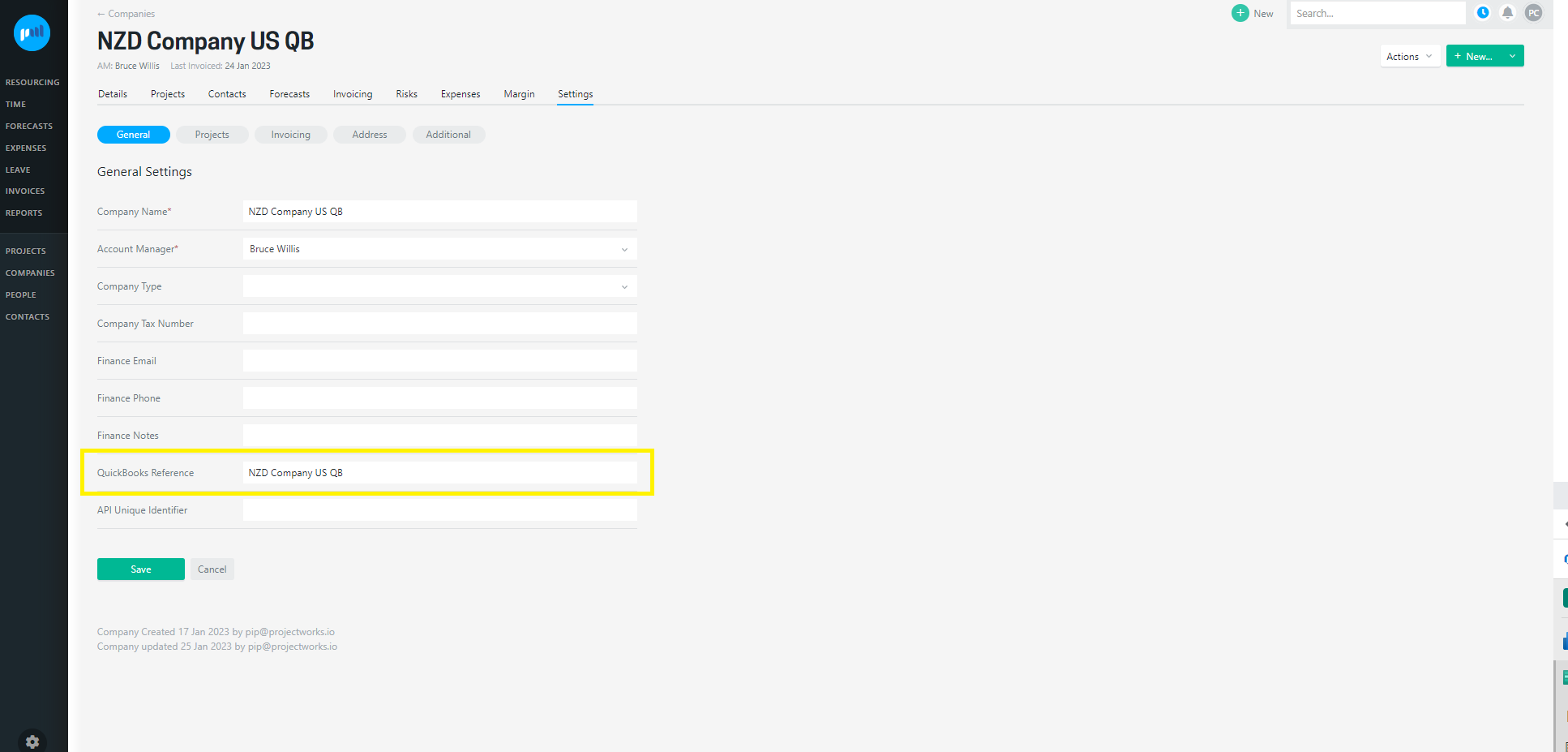

Error message: Contact reference <Company name> no longer exists in accounting system

Error message: Customer reference '<Company reference>' no longer exists in accounting system

A company QuickBooks reference is no longer valid for the QuickBooks organisation you are exporting the invoice to.

-

Remove QuickBooks reference from company in Projectworks

-

Go to: Company > Settings and clear out the value in this field

- Re-export the invoice from Projectworks

-

Error message: Customer could not be created. Multiple currencies per customer are not supported in QuickBooks.

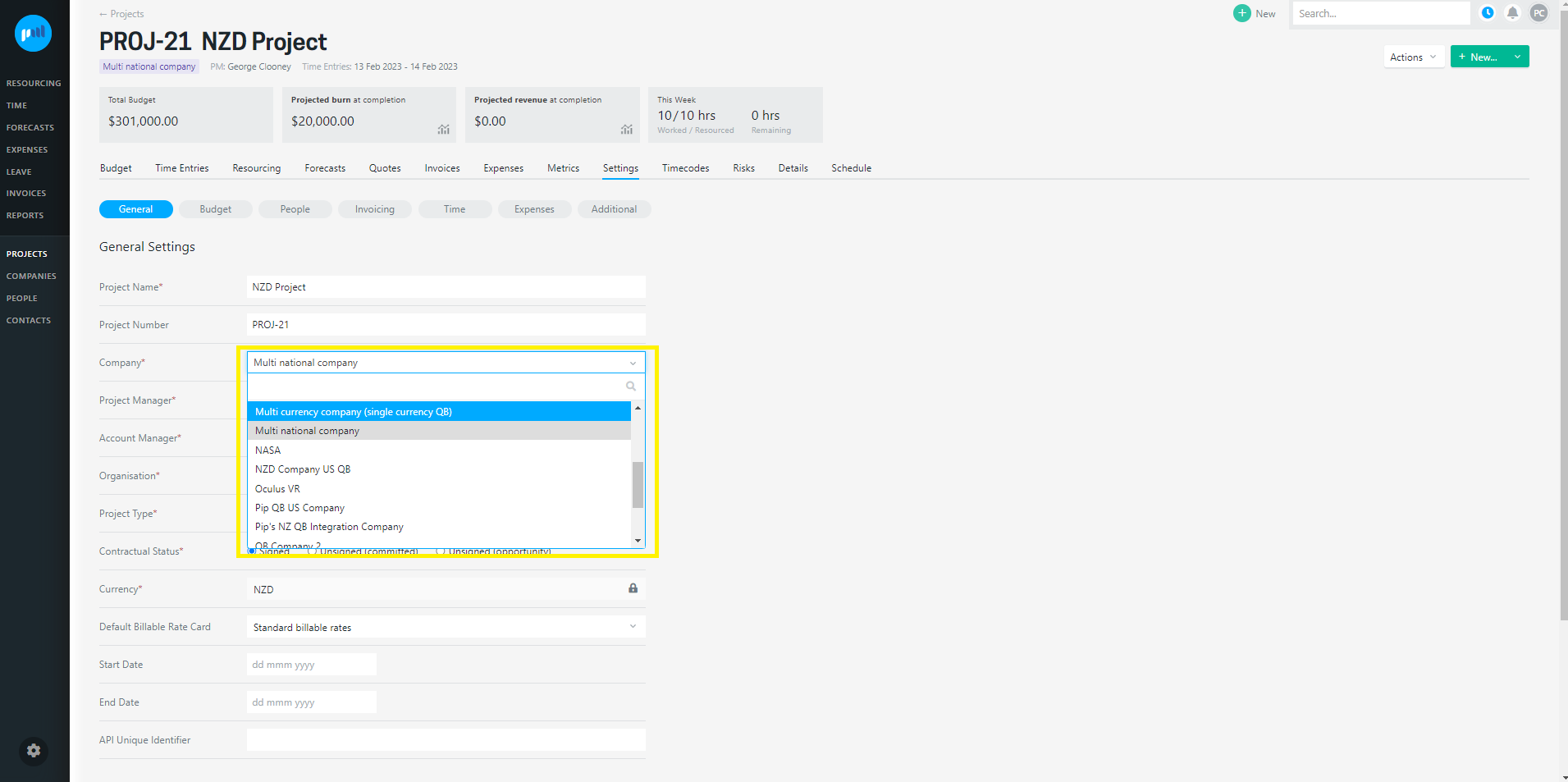

QuickBooks customers can be set up to pay you in a single currency only. If a Projectworks company has projects set up to pay you in different currencies, you will need to create an individual Projectworks company for each currency.

-

Create a new company in Projectworks

-

Select the ““+” icon on any screen and select “+” Company (Read more about adding a new company →);

-

Please note: when creating the new company in Projectworks, you should ensure the correct currency is selected.

-

-

Go to the project of the invoices that failed in Projectworks;

-

Withdraw and delete all invoices;

-

Update the company for the project (go to: Project > Settings);

-

Re-create, approve and export the invoices as required.

The company cannot be updated for a project in Projectworks if there are any quotes or invoices raised against it.

Error message: Invoice/credit memo could not be exported. Sales tax is not enabled in the QuickBooks company.

Go to Taxes in QuickBooks

-

Enable automatic Sales Tax or add a new Sales Tax rate

-

Re-export the invoice

Error message: Invoice/credit memo could not be exported. Exchange rate is not available for the invoice date.

- If the invoice date is in the future, wait for the invoice date to occur and re-export the invoice.

Please note: If you have raised an invoice for today in a country that is ahead of the Xero or QuickBooks country version, the invoice will not be able to be exported until the following day when the exchange rate is available.

Error message: Invoice could not be created. Additional details from accounting system: Code: 6000, Element: , Message: A business validation error has occurred while processing your request, Detail: Business Validation Error: Make sure all your transactions have a <sales tax rate> before you save.

See Error message: A tax type must be selected for all invoice lines before the invoice can be exported

Error message: Invoice could not be created. Additional details from accounting system: Code: 6000, Element: , Message: A business validation error has occurred while processing your request, Detail: Business Validation Error: You can only use one foreign currency per transaction.

This error indicates that the Projectworks invoice has been raised in a currency that differs from the currency the customer has been set up with in QuickBooks. The Projectworks company name and currency must match the QuickBooks customer name and currency to successfully export the invoice to QuickBooks.

QuickBooks customers can be set up to pay you in a single currency only, so you cannot export invoices from Projectwork projects belonging to a company, where the currency differs from the QuickBooks customer:

-

If a QuickBooks customer has been created in the incorrect currency:

-

Inactivate the customer in QuickBooks;

-

Remove QuickBooks reference from company in Projectworks;

-

Go to: Company > Settings and clear out the value in this field

-png-1.png)

-

Re-export the invoice from Projectworks

-

-

-

If a Projectworks company has projects set up to pay you in different currencies, you will need to create an individual Projectworks company for the currency of the invoice that can’t be exported.

Please see: Customer could not be created. Multiple currencies per customer are not supported in QuickBooks.

Error message: Invoice could not be created. Additional details from accounting system: Code: 6100, Element: Line.SalesItemLineDetail.TaxCodeRef, Message: Invalid Line TaxCode in the request, Detail: Valid line TaxCodes for US should be TAX or NON. Supplied value: CustomSalesTax

Projectworks Tax Name for US QuickBooks should be mapped to TAX or NON (not CustomSalesTax)

-

Go to Settings > Integration> Accounting

-

Scroll down to the accounting system organisation and click on the three horizontal dots to “Edit Mappings” (ensure you are in the “Invoicing” tab if editing QuickBooks or Xero mapping)

-

Edit the Tax Types mapping to TAX or NON from the Tax Types dropdown options (CustomSalesTax is not applicable)

-

Select “Update Mappings”

-

Re-export the Invoices that failed

![]() For US QuickBooks customers we recommend operating in a no tax environment in Projectworks, and handling all tax requirements in QuickBooks

For US QuickBooks customers we recommend operating in a no tax environment in Projectworks, and handling all tax requirements in QuickBooks

Error message: Invoice # must be unique.

The invoice number of the invoice you are trying to export to Xero already exists in Xero.

- If the original invoice was raised in error:

- Delete the original invoice in Xero; and

- Re-export the invoice from Projectworks.

- If the original invoice should remain in Xero:

- "Withdraw (set to draft)" the invoice in Projectworks;

- Update the invoice number;

- Select "Approve (Finance)"; and

- Re-export the invoice from Projectworks.

Error message: SaleEventLine_NotIncomeAccount

This errors indicate that the Projectworks GL code that has been mapped to an MYOB Header Account that is not an Income Account

Please see error message: BusinessLine_AccountHeaderNotAllowed and BusinessLine_AccountPostable errors)

Error message: The account code <accountCode> from the invoice is not mapped to a valid accounting system account code. See: Settings > Accounting.

-

Go to Settings > Integration > Accounting

-

Scroll down to the accounting system organisation and click on the three horizontal dots to “Edit Mappings” (ensure you are in the “Invoicing” tab if editing QuickBooks or Xero mappings)

-

Edit the Revenue GL Codes mapping from the Account Name dropdown options

-

Select “Update Mappings”

-

Re-export the Invoices that failed

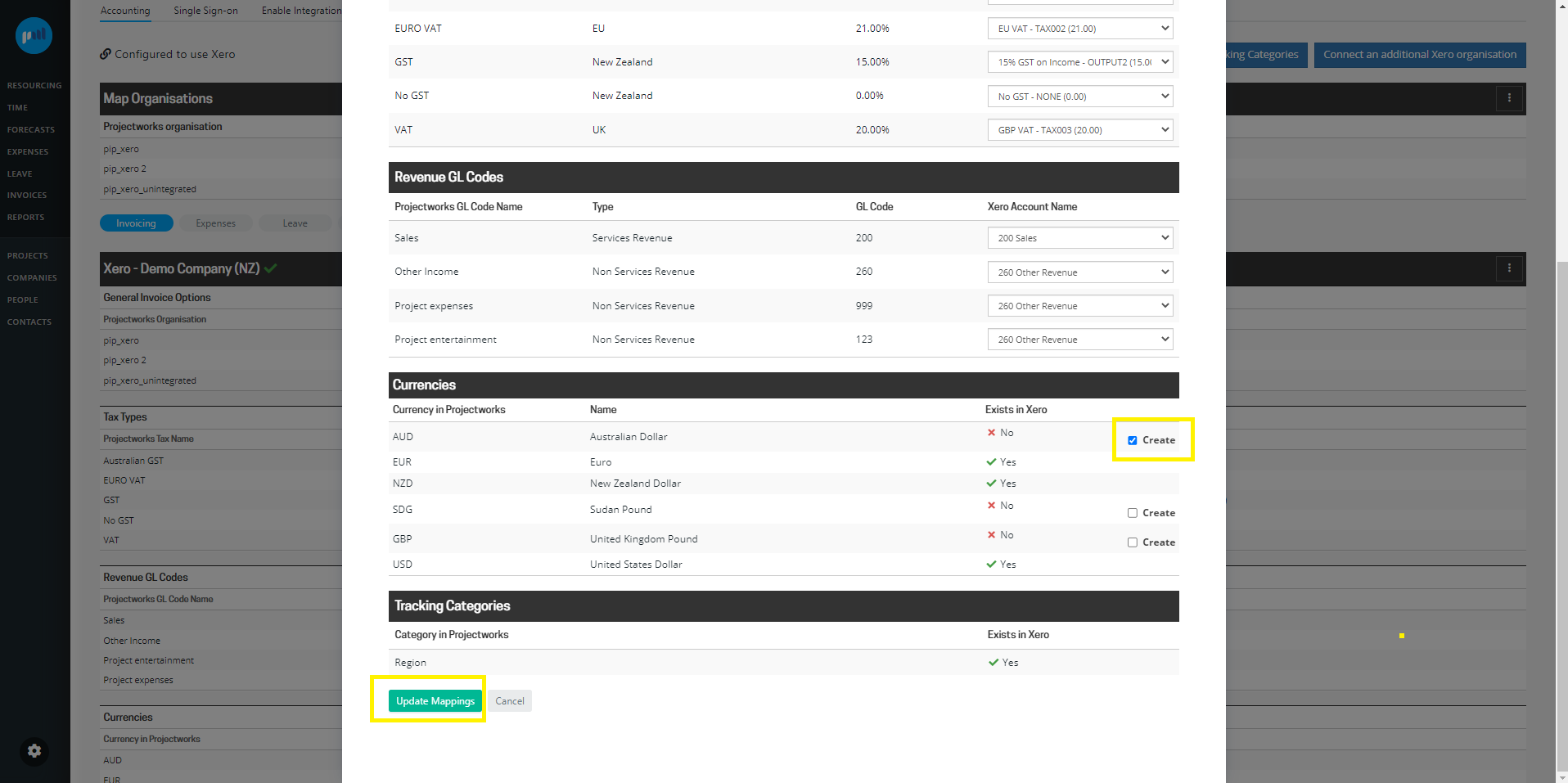

Error message: The invoice currency '<currency>' is not enabled in the accounting system. See: Settings > Accounting.

-

-

Go to: Settings > Integration > Settings > Invoicing;

-

Select the accounting system that you are trying to export to and click on the three horizontal dots to “Edit Mappings”;

-

Go to Currencies;

-

Select “Create” against the currency, and “Update Mappings”.

-

If you are using QuickBooks, and multicurrency has not been enabled, the QuickBooks administrator will be required to turn on multicurrency in QuickBooks before a new currency can be created in QuickBooks.

Error message: The organisation to which this invoice belongs is not linked to an accounting system organisation. See: Settings > Accounting.

- Go to Settings > Integration > Accounting

- Go to “Map Organisation” and click on the three horizontal dots to “Edit Mappings”

- Select the accounting system organisation from the dropdown for the Projectworks organisation you are mapping to

- Select “Update Mappings”

- Re-export the Invoices that failed

Error message: The TaxType code '<tax code>' cannot be used with account code '<account code>'.

The Xero tax rate mapped to the tax rate in Projectworks must be the same type (sales or purchase tax rate) as the default tax setting for the Xero account mapped to the invoice line in the invoice.

-

Check the default tax setting for the Xero account;

-

Update the Tax Types and Revenue GL Codes mappings in Projectworks as required (go to: Settings > Integration > Accounting > Invoicing)

-

Update the invoice if required;

-

Re-export the invoice.

Error message: The tax type <taxType> from the invoice is not mapped to a valid accounting system tax rate. See: Settings > Accounting.

-

Go to Settings > Accounting

-

Scroll down to the Accounting System and click on the three horizontal dots to “Edit Mappings” (ensure you are in the “Invoicing” tab if editing QuickBooks or Xero mapping)

-

Edit the Revenue Tax Types mapping from the Account Name dropdown options

-

Select “Update Mappings”

-

Re-export the Invoices that failed

If you cannot resolve your issue, contact support@projectworks.io.