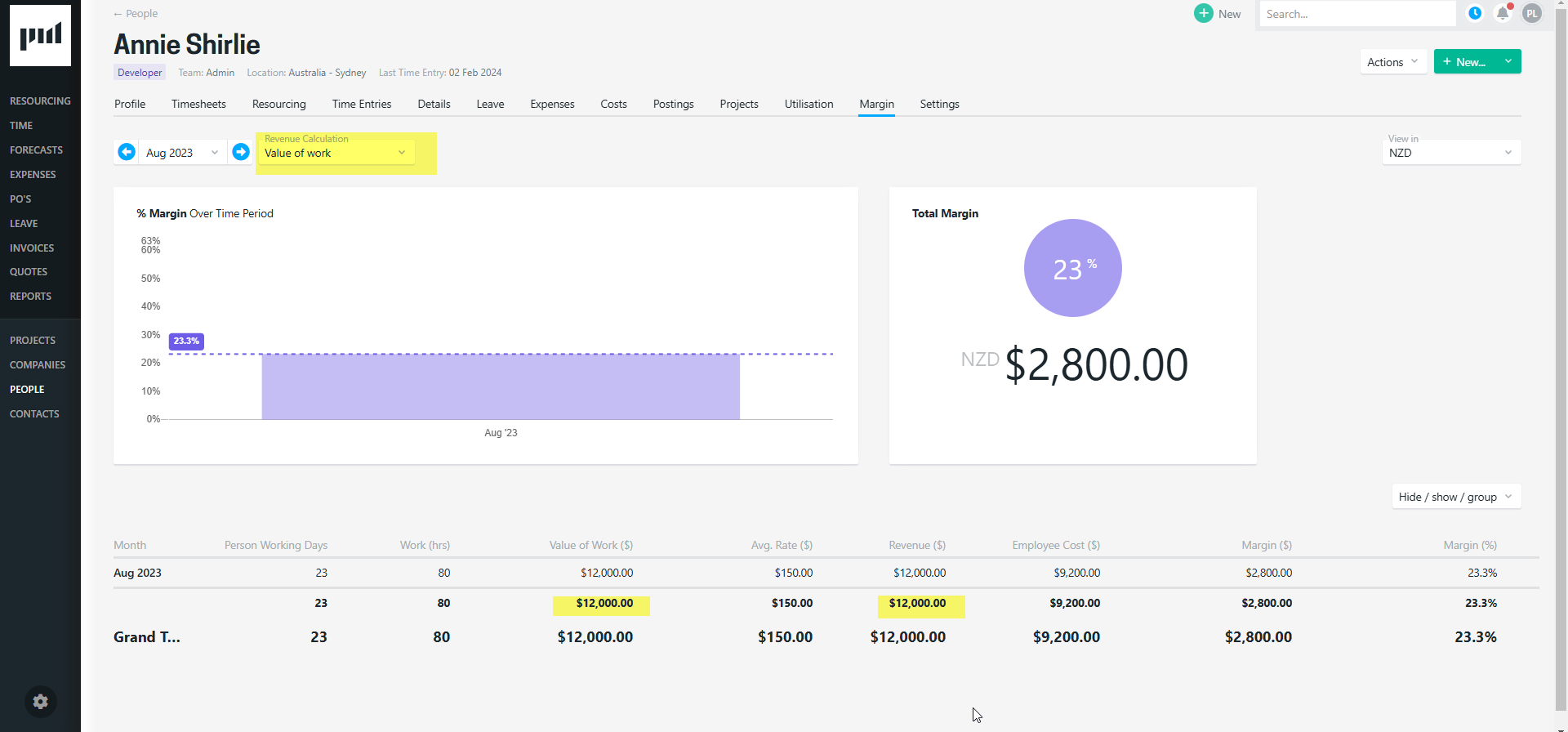

People margin reporting

People margin reporting makes it easy to see the contribution a person (or group of people) makes to revenue.

People margin reporting provides information to evaluate people’s productivity and financial value, and informs decision making to help increase efficiency and profitability.

Projectworks keeps track of the cost and value of billable work for a person, as well as the invoiced value of their billable time when invoices are approved.

Understanding People Margin

The Margin on a person = person’s Revenue MINUS Employee Cost

Margin (%) = person’s Margin DIVIDED BY Revenue

- Revenue

- Employee cost

- Margin by Person report and the Person Margin screen

- Work (hrs), Average Rate, and Value of Work

Projectworks enables you to view a person’s margin dependent on the Revenue Calculation you want to calculate the margin against:

-

Accrued revenue;

-

Invoiced work;

-

Value of billable work; or

- Value of work.

Accrued revenue

The accrued revenue is the expected revenue that can be realised for the person’s logged billable time (regardless of their billable rate).

The accrued revenue for a person is the:

-

Amount invoiced on time up to and including today, that has been included in manager, or finance, approved invoices dated up to and including the last day of the current month;

-

PLUS any uninvoiced billable hours up to and including today MULTIPLIED BY the person’s billable rate.

Please note: the sum of uninvoiced billable hours excludes the sum of hours written-off x billable rate.

Example 1: Annie logged 80 billable hours for July, and 80 billable hours for August for Project A

Annie’s billable rate on Project A is $150 p.h., so the value of work = $24,000 (160 hrs MULTIPLIED BY $150)

An approved invoice for her time has been raised for July’s time for the time entry amount of $12,000

Accrued revenue = $24,000 ($12,000 invoiced amount PLUS $12,000 uninvoiced billable amount (80hrs MULTIPLIED BY $150))

Example 2: Annie logged 80 billable hours for July, and 80 billable hours for August for Project A

Annie’s billable rate on Project A is $150 p.h., so the value of work = $24,000 (160 hrs MULTIPLIED BY $150)

-

An approved invoice for her time has been raised for July’s time for the forecast amount of $15,000

-

$3,600 (24 hours) of August’s time has been written off

Accrued value revenue = $23,400 ($15,000 invoiced amount PLUS $8,4000 uninvoiced amount ((80hrs MINUS 24hrs) MULTIPLIED BY $150))

In this instance:

-

80 hours invoiced for July have been marked up, and

-

80 hours for August have been marked down.

Please note: If a person has different billable rates for different timecodes or projects, the uninvoiced billable hours for each timecode will be multiplied by the associated billable rate (i.e. not the person’s target hourly billable rate).

Uninvoiced billable hours include any hours included in draft invoices.

Invoiced work

The invoiced work is the revenue amount that has been invoiced for a person’s logged billable time.

Please note: the revenue amount invoiced for the time may be more, or less, than the Value of Work (hours x rate).

The invoiced work for a person is the:

-

Amount invoiced on time up to and including today, that has been included in manager and finance approved invoices dated up to and including the last day of the current month.

Invoiced work excludes any billable work that is in a draft invoice (or has not yet been invoiced).

e.g. Annie logged 80 billable hours for July, and 80 billable hours for August for Project A

Annie’s billable rate on Project A is $150 p.h., so the value of work = $24,000 (160 hrs MULTIPLIED BY $150)

An approved invoice for her time has been raised for July’s time for the forecast amount of $15,000

Invoiced work revenue = $15,000 ($15,000 invoiced amount only)

Value of billable work

The value of billable work is T&M revenue that can be invoiced for a person’s logged billable time (based on their billable rate). It ignores the value of any time entries that have been written-off, or any time logged on non-billable timecodes that have a burn rate associated to them.

The value of billable work for a person is the:

-

Billable hours up to and including today MULTIPLIED BY the person’s billable rate.

The value of billable work does not take into account any invoiced amounts and excludes written-off time.

e.g. Annie logged 80 billable hours for August for Project A:

-

56 hours on a billable timecode, at a billable rate of $150 p.h.;

-

24 hours on a non-billable timecode, at a burn rate of $150 p.h..

Value of billable work revenue = $8,400 (56hrs (hour logged to the billable timecode) MULTIPLIED BY $150)

Please note: If a person has different billable rates for different timecodes or projects, the billable hours for each timecode will be multiplied by the associated billable rate (i.e. not the person’s standard hourly billable rate).

Value of work

The value of work is T&M revenue that you would have realised for a person’s logged time (based on their billable rate and burn rate). It takes into account any time that has been written-off or has been logged to a non-billable timecode with a burn rate, so that you have visibility of the potential T&M revenue for the person.

The value of work for a person is the:

-

Billable + non-billable hours up to and including today MULTIPLIED BY the person’s billable, or burn, rate.

The value of work does not take into account any invoiced amounts, but includes:

-

written-off time x billable rate; and

-

non-billable time x burn rate.

e.g. Annie logged 80 billable hours for August for Project A:

-

56 hours on a billable timecode, at a billable rate of $150 p.h.;

-

An approved invoice for her time has been raised for August’s time for the forecast amount of $3,000

-

-

24 hours on a non-billable timecode, at a burn rate of $150 p.h..

Value of work revenue = $12,000 (80 hrs MULTIPLIED BY $150) (i.e. the $3,000 invoiced amount is disregarded)

Employee Cost

If a person is a salaried or fixed employee their employee cost fluctuates on a month-by-month basis, based on their working capacity for the month.

e.g. Annie is an employee who works eight hours a day four days a week (Monday through Thursday). So Annie’s capacity will fluctuate dependent on the month, e.g.

-

June 2024 = 16 days working capacity

-

July 2024 = 19 days working capacity

-

August 2024 = 17 days working capacity

-

September 2024 = 17 days working capacity

-

October 2024 = 19 days working capacity

So Annie’s costs will be higher in July and October than in June, August, and September.

Hourly contractors' costs will fluctuate dependent on how many hours they log in Projectworks, so their monthly costs will change dependent on how many hours they have worked in a month.

e.g. If a salaried or fixed employee is on leave for two weeks of the month, they are paid their regular salary.

Whereas if an hourly contractor is on leave for two weeks, their employee cost will be reduced by around half for that month in comparison to the previous months where they worked the full month.

Margin by Person report and the Person Margin screen

The Margin by Person report allows senior management to view a group of people’s margins in one report, whereas the Person Margin screen displays the margin for a specific individual only. It is not uncommon that access to the Margin by Person report will be more restricted, due to the sensitive nature of cost information.

Read more about access to the Margin by Person report and Person Margin screen →

There are a number of filters available to slice and dice the Margin by Person report and gain visibility across manager, team, role etc.

Work (hrs), Average Rate, and Value of Work

Work (hrs)

Work (hrs) include all hours logged to billable projects. This includes billable and non-billable timecodes. Time logged against non-billable timecodes cannot be invoiced, however the billable rate is based on the total number of hours worked on the billable project.

Average Rate

A person’s average rate (Avg. Rate) gives you an indication as to whether their hourly rate is above or below their standard hourly billable rate. People and projects may have revenue targets that you base people’s hourly rates on, however if a person’s billable rate is consistently marked down, revenue targets are unlikely to be met.

Avg. Rate = Revenue DIVIDED BY Work (hrs)

A person’s Avg. Rate may fluctuate, dependent on the revenue calculation that is being used.

Value of Work

A person's Value of Work = Work (hrs) up to and including today MULTIPLIED BY the person’s billable, or burn, rate.